|

|||||

AI Powered Assistant to Help Bring Relief to Student Loans |

|||||

|

|||||

About the Client:PeopleJoy is like TurboTax for student loans; it can help individuals manage their student loans and sign up for new repayment plans managed by PeopleJoy.PeopleJoy will soon launch a new version of their online student loan AI assistant "ED". ED provides users with an easy to understand platform where they can upload their loan information, determine what the user's goals are, and suggest to the user a repayment plan that is personalized for their specific student loan. Challenge:PeopleJoy needed help designing a sales funnel to help move customers through the process and, ultimately, buy a student loan management plan. To achieve a successful sales funnel, we had to design something that built trust in PeopleJoy, showed the value of their product, and easily informed customers the differences between the loan management plans. Currently, PeopleJoy works directly with its users in person where they have a high success rate but know they need the website to be as effective if they want to scale.Goal:Understanding the user's need in order to create a responsive website that maintained the same level of understanding users have when working directly with a PeopleJoy representative. This is necessary for scaling their business to a wider customer base.Phase 1: Research & SynthesizingWhile our team waited for a list of current PeopleJoy users to interview, we created a screener survey to find additional people who currently had student loans, were looking to lower their monthly payments, and were unfamiliar with PeopleJoy. Having two users interview groups allowed us to determine what kind of information all users knew about their loans and what kind of information people learned by working with PeopleJoy.After conducting the non-PeopleJoy user interviews, we affinity mapped the observations and it was clear that most people take out loans not knowing much about them or how they work. Some insights that we found were:

|

|||||

|

|||||

| We concluded that PeopleJoy users had almost all the same goals, needs, and pain points as non-users which led us to make a single persona that included all users with student loans. | |||||

|

|||||

Taking into account the persona and all additional information we gathered from the user interviews, we were able to come up with the following problem statement:

At the time students take out a loan, they often do not have the time or resources to educate themselves enough to understand how student loans work. Phase 2: Usability Testing Current ProductTo create a baseline understanding of how the site currently worked, we conducted usability tests on individuals we found through a screener survey again to confirm they had student loans and were looking to lower their monthly payments. Through user tests we found:

|

|||||

|

|||||

| Existing PeopleJoy Mobile Screens | |||||

Phase 3: Ideate, Proposed SolutionBased off of our problem statement and one round of usability testing the current product, we concluded that users would only be interested in buying PeopleJoy's product if they felt comfortable and confident in the information they were presented.The first step in accomplishing this involved educating all users about the basics of student loans so that we could begin to build confidence in their understanding. To achieve this, we reworked the the site to include an "onboarding" section to start. The onboarding process included simple terms users shared they didn't know in the user interviews. "I know there are different types of loans, but I don't always remember what they are." User 1 |

|||||

|

|||||

| Student Loan Education Screens (Onboarding) | |||||

Topics included:

"All of my loan information was scattered. Something got lost in translation...I felt absolutely scared, terrible and just a little defeated." User 1 |

|||||

|

|||||

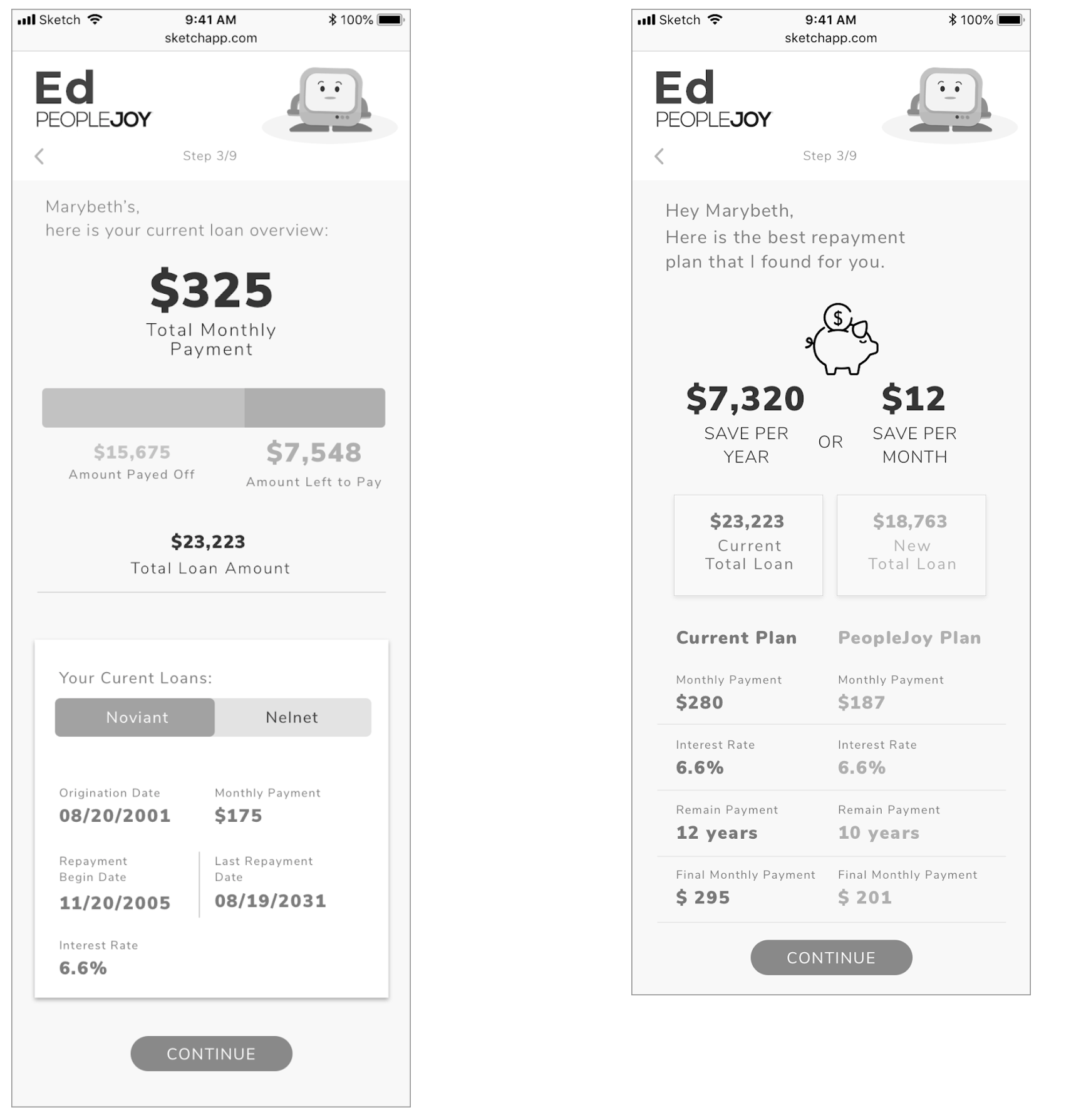

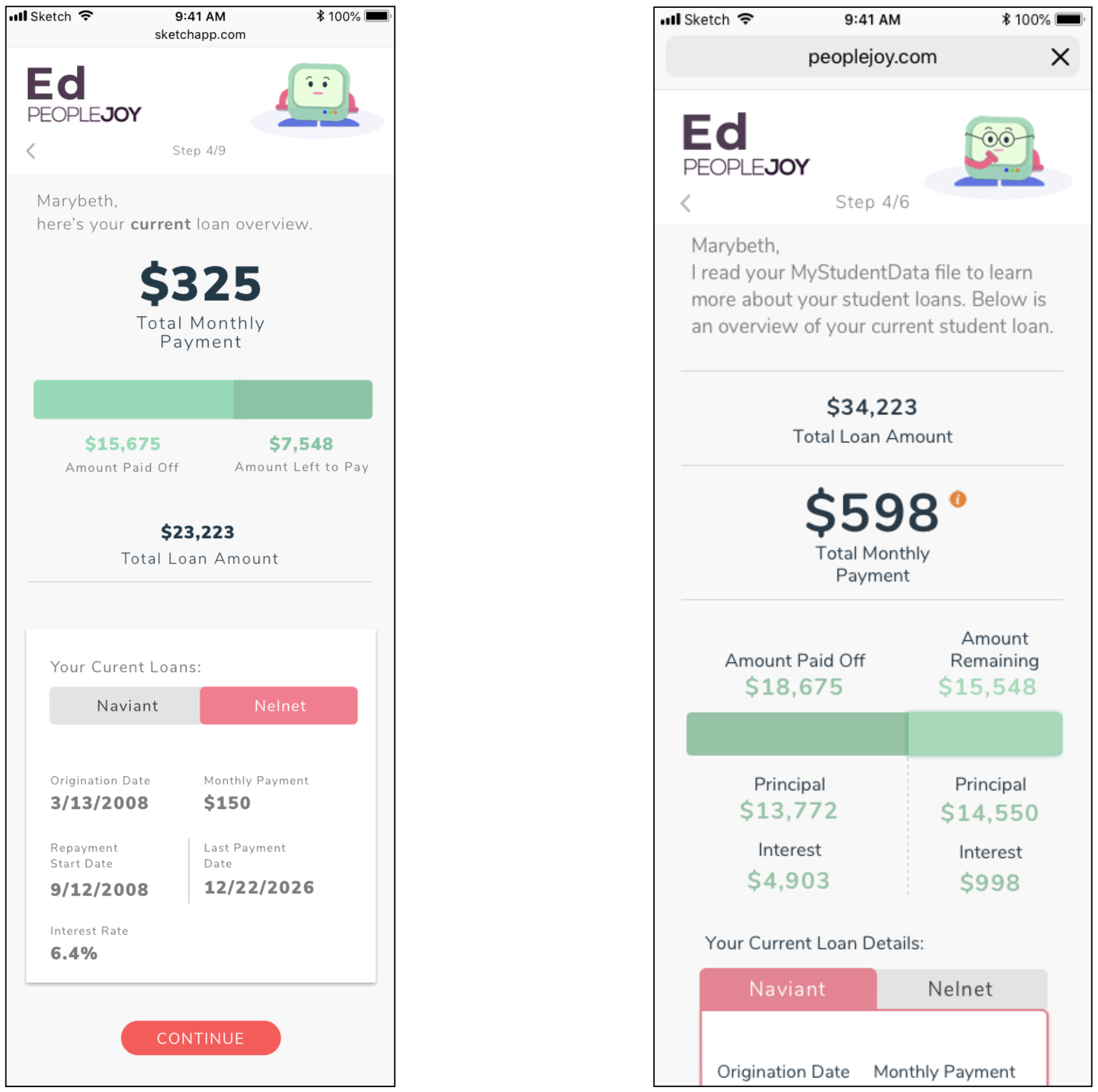

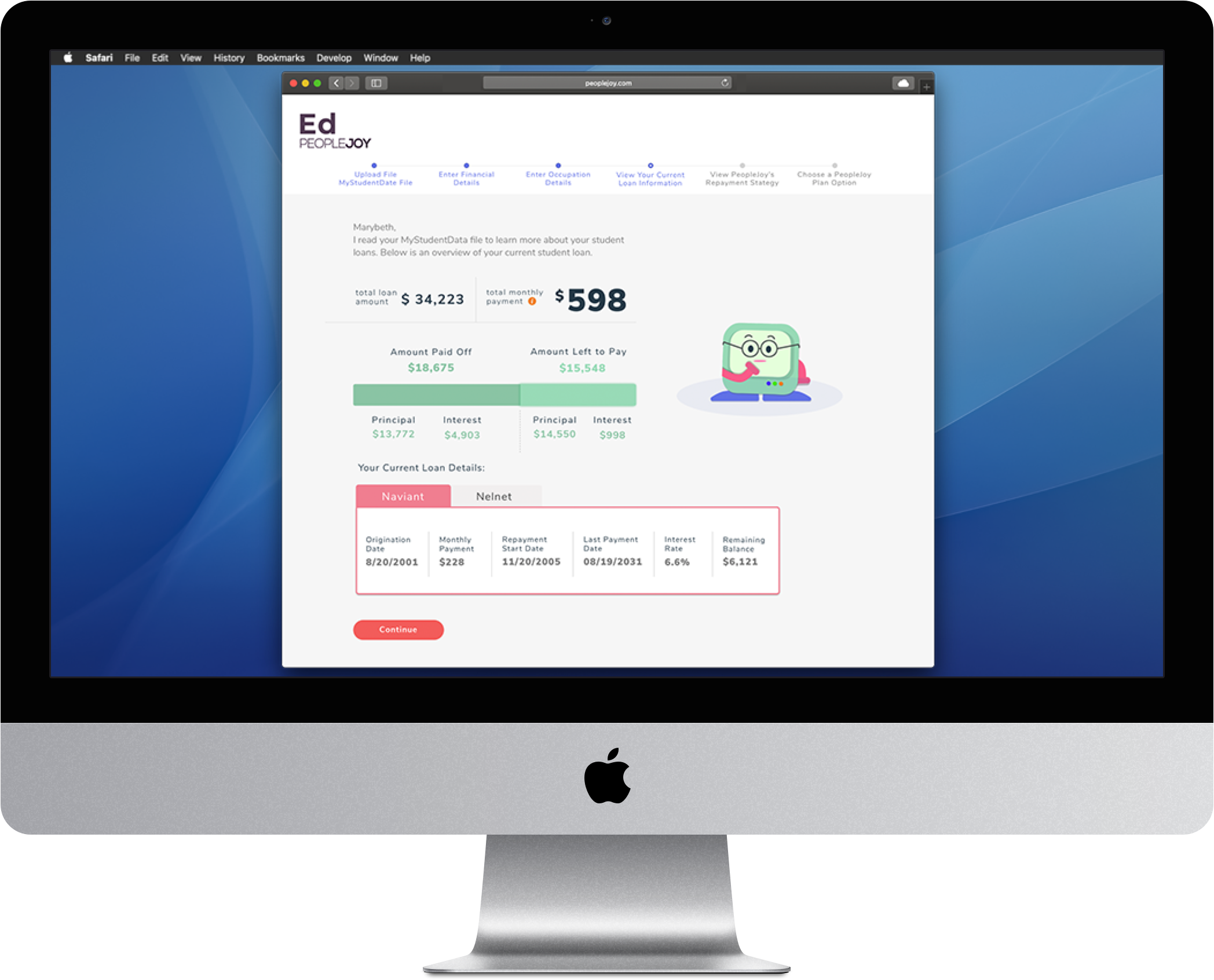

| Your Loan Overview & Loan Comparison to PeopleJoy Screens |

|||||

|

|||||

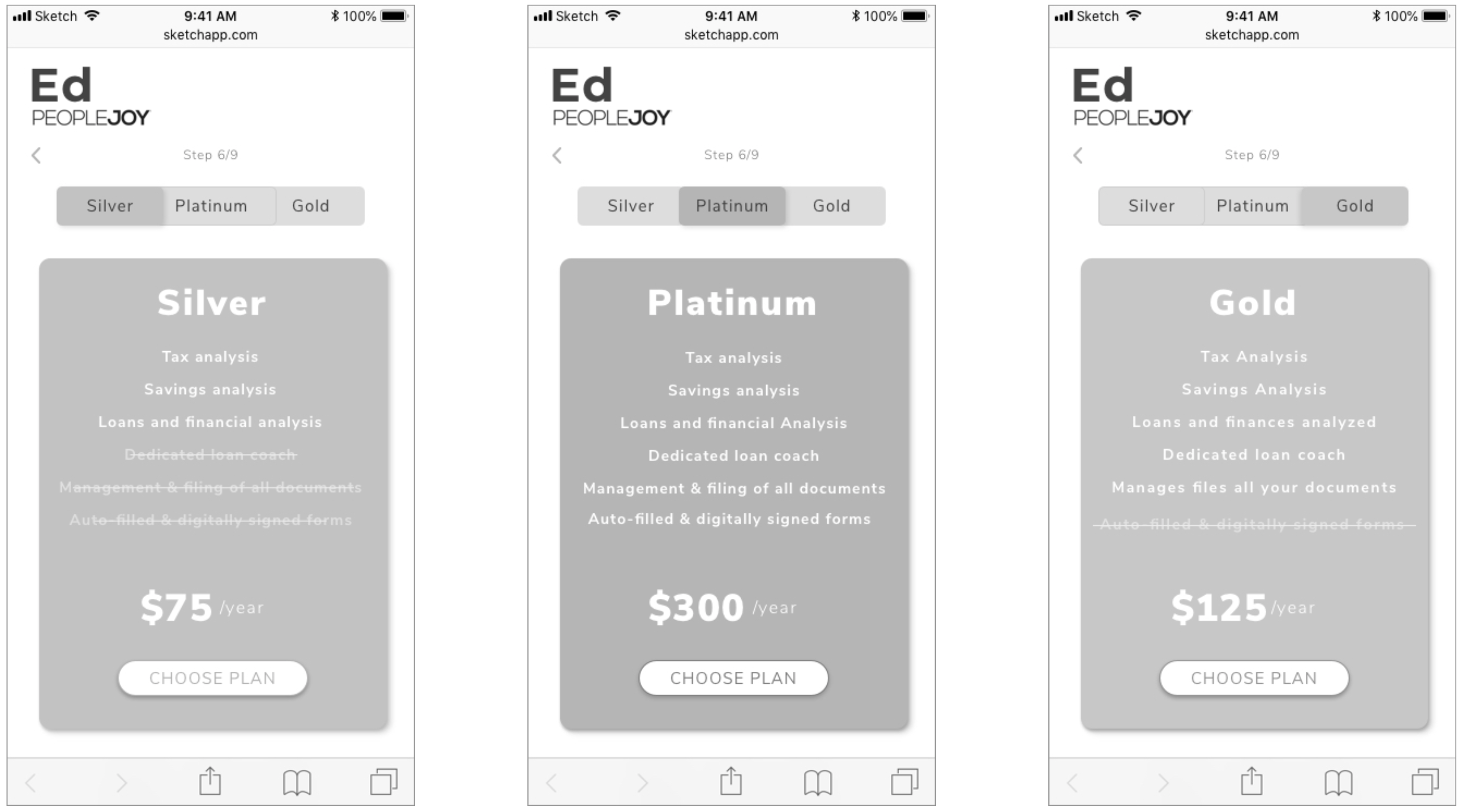

| Student Loan Management Payment Plan Screens | |||||

Phase 4: Usability Testing New Mid-Fi Prototype & IterateWith a new working prototype, our next step was conducting usability tests on users. Again we found users through a screener survey confirming users had student loans and were looking to lower their monthly payments. The users found success in our new educational feature but still struggled with the information about their loans and what PeopleJoy could offer them.Success:

|

|||||

|

|||||

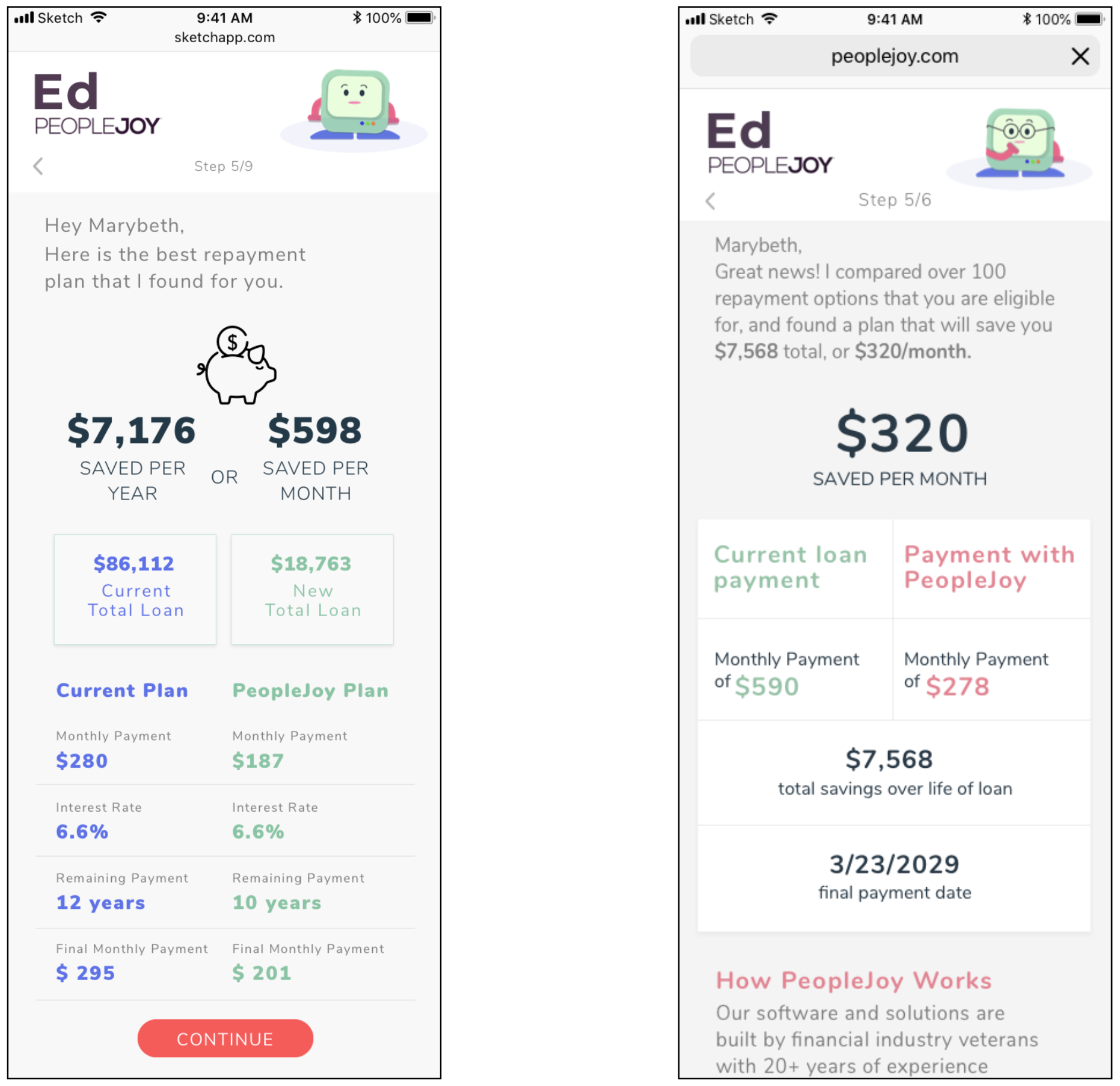

| Loan Savings From PeopleJoy Screen (first version left, iterated version right) | |||||

|

|||||

|

|||||

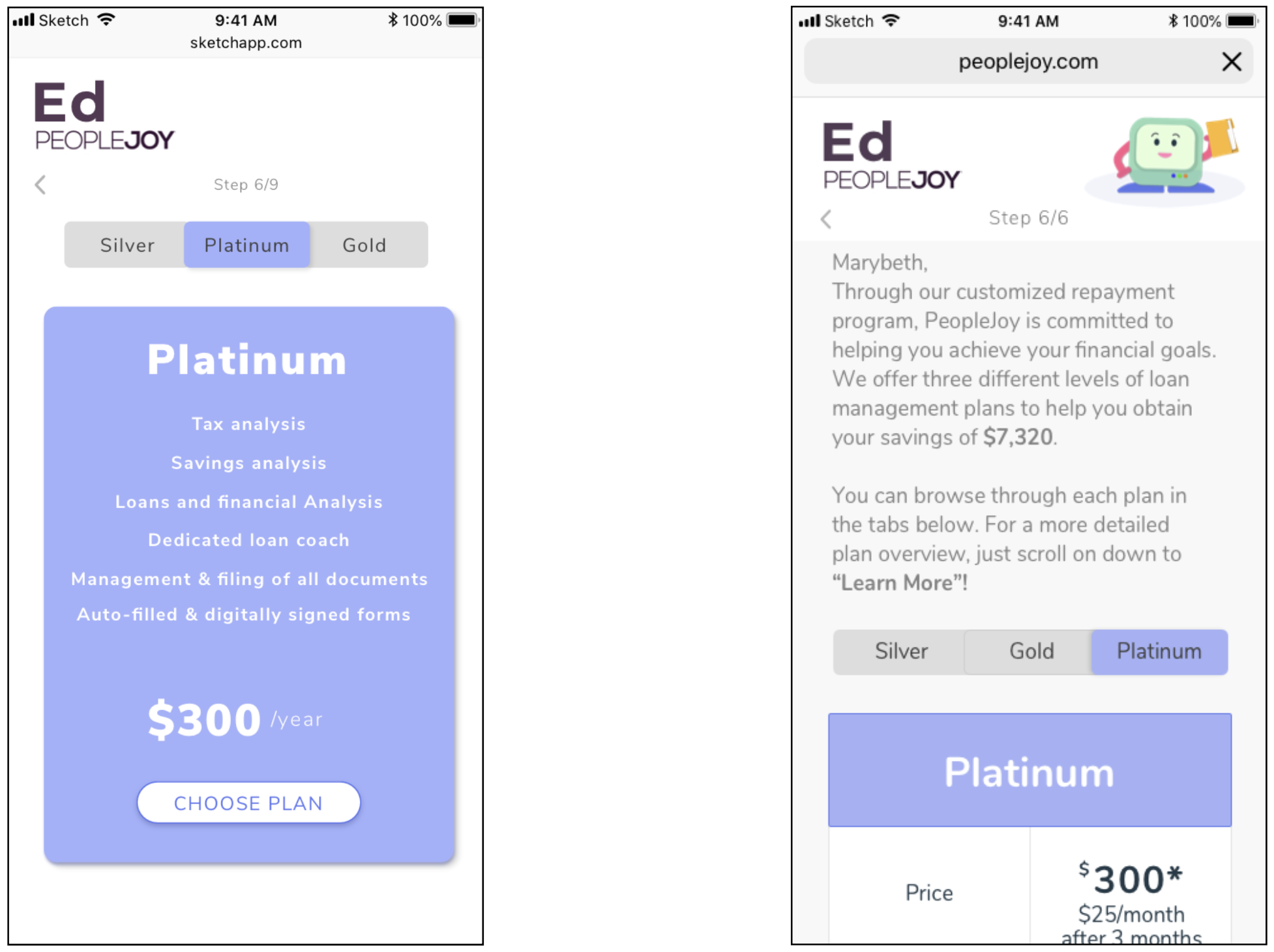

| PeopleJoy's Plans Screen (first version left, iterated version right) | |||||

|

|||||

|

|||||

| Your Loan Overview (first version left, iterated version right) | |||||

|

|||||

Phase 5: Hi-Fi PrototypeAfter receiving comments from the Mid-Fi usability testing, we iterated the design within the mobile flow to include changes we observed from the users. Then we took all the changes we made through the mobile breakpoint and introduced them into the desktop breakpoint. The larger screen allowed us to combine a few screens and include the video tutorial right within the screen. |

|||||

Click screen below for Invision Prototype |

|||||

|

|||||

|

|||||

| Home Emotion Slider Ranger Bot MTA Subway | |||||

|

|||||